The Ultimate Guide To Medicare Advantage Agent

Table of ContentsThe Buzz on Medicare Advantage Agent9 Simple Techniques For Medicare Advantage AgentThe Only Guide to Medicare Advantage AgentThe Definitive Guide for Medicare Advantage Agent5 Easy Facts About Medicare Advantage Agent DescribedThe Best Strategy To Use For Medicare Advantage Agent

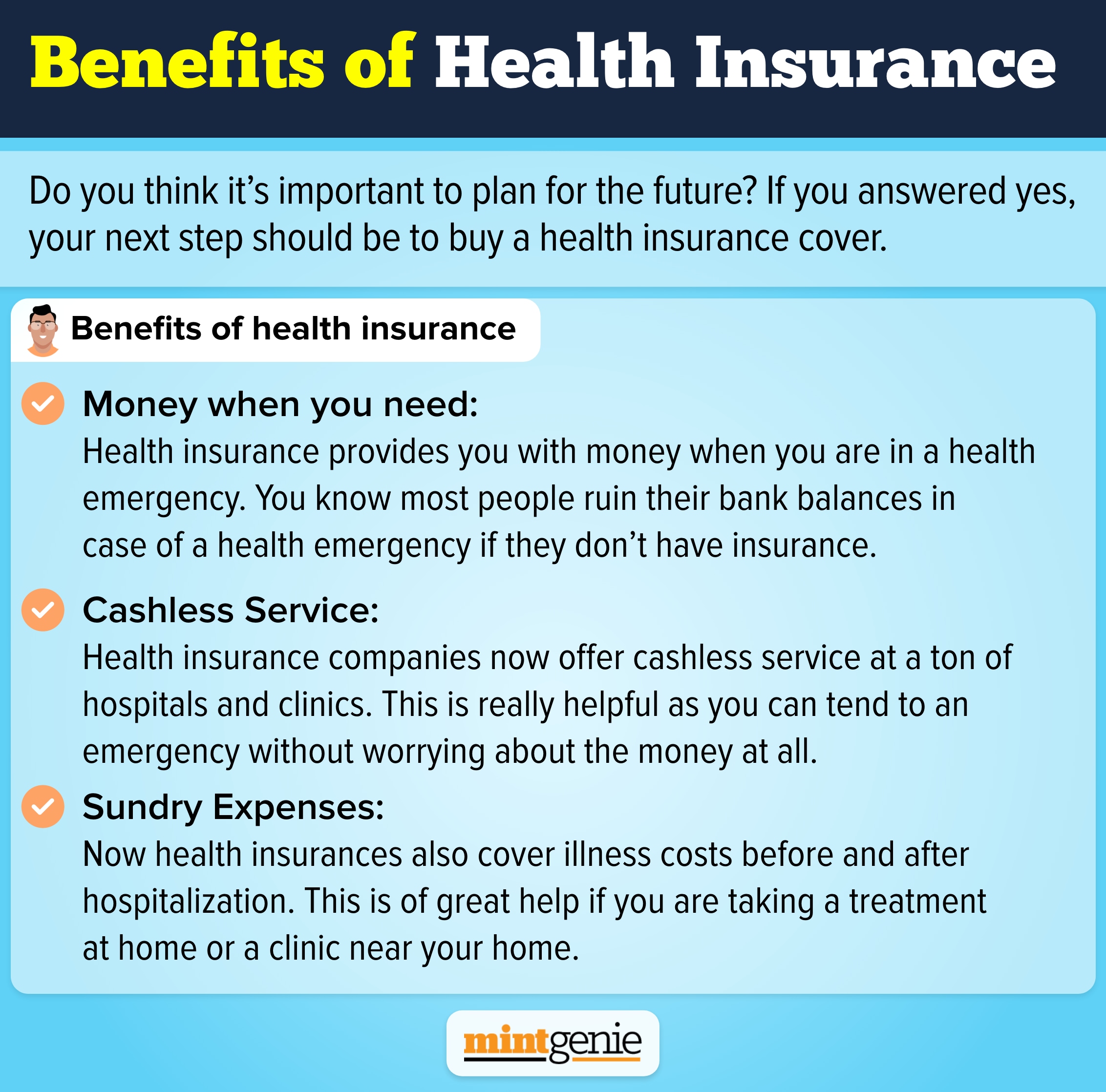

The independent and direct impact of health and wellnessinsurance coverage on access accessibility health wellness solutions well established. For still others, wellness insurance policy alone does not make sure invoice of treatment because of various other nonfinancial barriers, such as a lack of health treatment companies in their area, restricted access to transport, illiteracy, or linguistic and social differences. An adjustment in insurance premium or terms, as well as adjustments in income, wellness, marital condition, terms of employment, or public policies, can trigger a loss or gain of health insurance coverage.

The federal government pays greater than it needs to for these strategies, while the involved companies make a bigger profit. This video game includes business paying medical professionals to report even more health and wellness troubles, sharing the additional money with medical professionals, and even owning the physician's workplaces. Getting ill can be costly. Also small diseases and injuries can set you back thousands of bucks to identify and treat.

Health care coverage helps you get the treatment you require and safeguards you and your family financially if you get sick or harmed. Enjoy: Are you suddenly needing health insurance policy? All health plans require you to

pay some of the cost of your health careHealth and wellness

The Best Guide To Medicare Advantage Agent

The federal government pays more than it should for these strategies, while the included firms make a larger profit. This video game includes companies paying medical professionals to report more health troubles, sharing the additional cash with physicians, and even owning the physician's offices.

Significant health problems can set you back often times that. Wellness care insurance coverage helps you obtain the care you require and secures you and your household monetarily if you get ill or harmed. You can get it via: Your job or your partner's job, if the company offers it. You need to meet eligibility requirements for government healthcare programs. To learn more about federal government programs, go to Benefits.gov. Find out a lot more: Health insurance coverage: 5 points you might not know Enjoy: Are you suddenly requiring medical insurance? You can include your family members to a job health insurance plan. If you purchase from an insurance provider or the market, you can buy

separated, having a child, or embracing a kid. You can authorize up for a job health insurance plan when you're initial worked with or have a significant life modification. They can not deny you protection or cost you much more as a result of a pre-existing condition or disability. The price depends on your situations. You'll have to pay premiums and part of the expense of your treatment. A costs is a monthly cost you pay to have coverage. To choose your premium, insurance provider will consider: Your age. Whether you smoke or utilize tobacco. Whether the coverage is for one person or a household. They may rule out your sex or wellness variables, including your case history or whether you have a special needs. Premiums for private strategies are locked in for one year. Rates usually go up when the strategy is renewed to show your age and higher health and wellness care expenses. All health insurance plan require you to.

Rumored Buzz on Medicare Advantage Agent

pay several of the expense of your wellness treatment. This is called cost-sharing. In enhancement to costs, you typically must meet a deductible and pay copayments and coinsurance. A is the quantity you must pay prior to your plan will certainly pay. For instance, if your deductible is$ 1,000, your plan will not pay anything up until you've paid $1,000 on your own.

The government pays even more than it must for these strategies, while the entailed companies make a bigger earnings. This game consists of firms paying medical professionals to report even more wellness troubles, sharing the extra money with doctors, and also possessing the medical professional's workplaces.

Unknown Facts About Medicare Advantage Agent

Significant illnesses can cost sometimes that. Health treatment insurance coverage aids you obtain the treatment you require and shields you and your family members economically if you get ill or harmed. You can get it through: Your task or your spouse's job, if the company uses it. You must fulfill qualification demands for government healthcare programs. For more details concerning federal government programs, browse through Benefits.gov. Discover more: Health and wellness click here for more info insurance coverage: 5 points you might not understand Watch: Are you instantly requiring medical insurance? You can include your household to a work health insurance. If you purchase from an insurance provider or the market, you can purchase

a plan that likewise covers your family members. They don't need to live in the house, be enrolled in institution, or be claimed as a reliant on your income tax return. You can maintain wedded kids on your strategy, but you can't add their partners or youngsters to it. If you have dependent grandchildren, you can keep them on your plan up until they transform 25. You can buy at other times only if you lose your insurance coverage or have a life change. Life changes consist of things like marrying or

divorced, having a child, or adopting a child. You can register for a work health insurance plan when you're very first worked with or have a significant life adjustment. They can't reject you insurance coverage or cost you extra due to a preexisting condition or impairment. The cost depends on your situations. You'll have to pay premiums and part of the cost of your treatment. A costs is a month-to-month cost you pay to have insurance coverage. To choose your costs, insurer will consider: Your age. Whether you smoke or use tobacco. Whether the protection is for a single person or a family. They may rule out your sex or health and wellness factors, from this source including your case history or whether you have a handicap. Costs for private plans are locked in for one year. Fees normally go up when the plan is renewed to mirror your age and greater healthcare prices. All health insurance plan need you to.

pay several of the expense of your health and wellness treatment. This is called cost-sharing. Along with premiums, you generally must meet a deductible and pay copayments and coinsurance. A is the quantity you must pay before your strategy will pay. For example, if your insurance deductible is$ 1,000, your strategy will not pay anything up until you've paid $1,000 on check this your own.